US Jobless Claims Fall, PPI Remains High, the FED Backs Off on Inflation

EUR/USD reverses lower as US economy and inflation increase

Earlier today we posted an article explaining how the European Central Bank ECB is still brushing raising inflation under the carpet, as ECB president Christine Lagarde commented today. The FED on the other hand, has accepted defeat and has acknowledged high inflation figures as not temporary any longer and is backing it up with action, after having decided to reduce the QE monthly purchases, until it ends next year. Inflation is substantially higher in the US though, being above 5% since the beginning of summer.

So, there’s reason for the FED to start acting next month. The PPI (producer price inflation) remains exceptionally high as September’s report showed today, while unemployment claims fell below 300K for the first time since the pandemic started. We sold EUR/USD with two forex signals earlier today, on this basis and are already well in profit on both of them.

Unemployment Claims Report

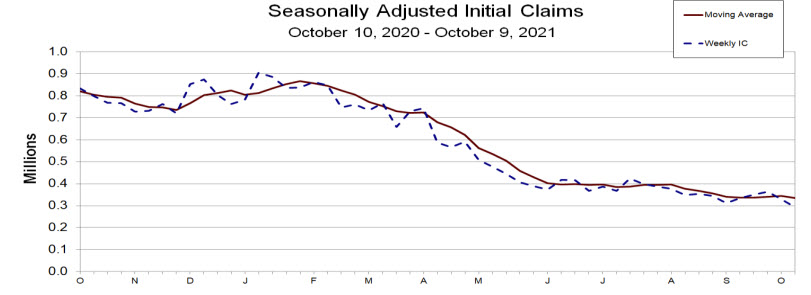

Jobless claims fall below 300K for the first time since the start of the pandemic

- Jobless claims 393K vs 319K estimate

- Prior week revised to 329 from 326K previously reported

- 4 week average 334.2 vs 344K last week

- Continuing claims 2.593M

- 4 week moving average 2.737M vs 2.768M last week

- The largest increases in initial claims for the week ending October 2 was in Pennsylvania (+1,707),

- The largest decreases were in California (-14,733), District of Columbia (-3,905), Michigan (-3,370), Missouri (-2,598), and Texas (-2,376)

- Full report

The trend to the downside is good news for the next jobs report. The claims data did start to move to the downside but it did not start to move lower until after the survey week from last month’s jobs report. The jobs report released last Friday came in weaker than expected at 194K vs 490K estimate. The prior 4 weeks of claims have come in at 332K, 351K, 362K and 326K. The fall to 293K is a 19% improvement.

Highlights of the September PPI report

- September PPI YoY 8.6% vs 8.7% expected

- October PPI YoY was 8.3%

- Core PPI excluding food and energy 6.8% vs 7.1% expected

- PPI MoM +0.5% vs +0.6% expected

- Core PPI ex. MoM food and energy +0.2% vs +0.5% expected

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account