Compound (COMP) – Forecast Summary

| Compound Forecast: H2 2021 Price: $202 – $375 Price drivers: COVID-19, Technical indicators, Crypto market sentiment | Compound Forecast: 1 Year Price: $375 – $650 Price drivers: Post COVID-19, Central banks, USD reversal, DeFi market | Compound Forecast: 3 Years Price: $650 – $2500 Price drivers: DeFi market, Tighter monetary policies, Crypto market sentiment |

The native token of Compound which is the COMP, or as it is usually displayed COMP/USD, is a newcomer to the cryptocurrency market, being introduced on June 15 2020, which means that it is less than a year old. Compound itself also started life a few years ago, back in 2017 and became an interesting blockchain protocol for the DeFi world of the crypto market. That became evident when the COMP coin was launched in June last year; it became the leader of the decentralized finance DeFi world in just a single day, a position it still holds.

The Compound price is currently trading near USD 321.41 with a 24-hour trading volume of USD 402,172,137. The Compound is up 21.67% in the last Twenty-Four hours. The cryptocurrency market experienced its best period of growth in the past year(2020)— most coins achieving new all-time highs. However, one of the areas in the cryptocurrency space to garner the most attention is the decentralized finance (Defi) area. Defi has gained a lot of demand as more people entered the crypto space searching for alternative financial solutions.

The Compound (comp) is one of the leading Defi protocols, allowing it to gain huge adoption within the crypto space. Therefore, Compound is a cryptocurrency of interest for many investors and traders, and they would like to know how its price has been performing so far. COMP, Compound’s native token, has traded nicely so far this year(2021). At the start of the year, COMP was trading at $148 per coin. However, the cryptocurrency market rally picked up from where it left off last year, and COMP continued its upward trajectory, reaching its all-time high price of $911 per coin on 11 May. Compound’s current value is $321.62, which is around 64.89% below its all-time high of $910.54 on Wednesday, 12 May. On the different page, the cryptocurrency market recently faced a heavy market crash, which is why cryptocurrencies stuck in a bearish trend for the past few weeks. Many cryptocurrencies have dropped sharply from their all-time highs. COMP is also seen as one of the cryptocurrencies to suffer from the current bearish cycle. Comp current value is at $321.62, 421.27% above its all-time low of $910.54 on Thursday, 18 June.

Recent Changes in the Compound Price

| Period | Change ($) | Change % |

| 1 Month | -44.26 | -14.23% |

| 2 Months | -333.01 | -107.13% |

| 3 Months | -333.01 | -28.12% |

| 6 Months | +160.39 | +51.60% |

| Since Introduction | +232.24 | +74.71% |

Factors Affecting Compound

In short, Compound is a decentralized lending application. Holders of a number of supported cryptocurrencies can lend in this application, while others can borrow these digital currencies. The Compound protocol is developed on the Ethereum blockchain, which is the main backbone of DeFi. As we mentioned above, COMP token took the DeFi market by storm, which means that the expansion of this market will increase the demand for lending and borrowing, thus increase the demand for Compound. This new market has just started and looks very promising, so the future looks good for Compound and the native token COMP.

Since mid-February we have seen some heightened volatility for COMP/USD and the crypto market in general, which has gone both ways, suggesting that cryptocurrencies have become overbought for the moment, however, the dips have been bought quite aggressively nonetheless, which also shows that the buying pressure remains strong. Compound has formed a bottom at $320-$330 where strong buying pressure has been evident. We have seen another strong surge in the last two weeks, but the resistance at $560-$570 according to my crypto broker feed, has scared the buyers for the time being, so the 2-way price action continues.

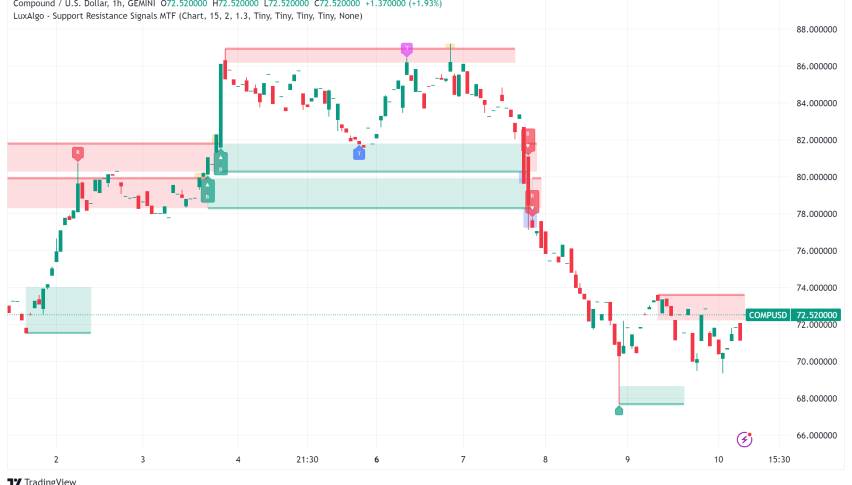

Compound Live Chart

Compound Price Prediction for the Next 5 Years

Compound lending and Borrowing Interest Pools

As we have explained in our cryptocurrency price predictions, there have been quite a few interesting cryptocurrencies and block-chain protocols/applications to come along in recent years, such as Basic Attention Coin BAT which acts as a blockchain bridge between the digital producers and consumers, TRON and ChainLink which offers the decentralized oracle network. Compound is another interesting idea to has come across in recent years, helping make Decentralized Finance more popular among the broader public. Compound is a lending and borrowing decentralized blockchain protocol. You can also have a say in the Compound governance and decision making if you own the native coin COMP.

As we know, there are many financial services besides the basic payments, like borrowing or lending for interest, insurance, savings, taxes etc. Decentralized finance aims to achieve one thing, to make all financial services decentralized, by using blockchain protocols and digital coins. Compound has settled well in this new DeFi environment, particularly the second stage with its lending and borrowing pools.

Compound basically offers a number of decentralized pools, which act as compound for crypto holders who would like to lend them to other people in need of such cryptos. These could be normal people who would like to use cryptos for payments, or as the surge in demand has indicated, they could be traders or investors, hoping that these cryptocurrencies will increase in value more than the interest they will have to pay. Obviously, the lenders earn interest from the borrowers and vice versa. But this is not all. You get cTokens when depositing cryptos in Compound pools or Compound wallets, for Ethereum you get cETH , for Basic Attention Coin you get cBAT etc and the interest you earn is in the deposited coins as well. You can earn interest according to the cToken which act as loan collateral, but at the same time, you can spend the cryptos as well until the minimum collateral amount. The interest is decided by the supply/demand ratio as in all financial institutions. If there are too many lenders and fewer borrowers in a pool, the interest will be lower, although lenders can choose to move to another pool, which has more borrowers than lenders. Likewise, if borrowers want lower interest, they will have to find a pool where there are more lending funds than borrowing demand.

Compound Token COMP

After three years of running as an application/protocol on the Ethereum network, Compound decided to introduce its own native token, called COMP. COMP/USD started life on June 15 last year, as we mentioned above at around $140 according to our cryptocurrency rates. That showed the increasing interest for DeFi and the COMP coin as a result. The COMP coin confers have voting rights to decide on important things like including new cryptocurrencies for borrowing and lending on the Compound platform, protocol upgrades or in the future, plans are that COMP holders might be able to vote for fee distribution, as well as for token buybacks.

At the moment, the following cryptos are supported in Compound: Basic Attention Token (BAT), Ether (ETH), Tether (USDT), Wrapped BTC (WBTC), Dai (DAI), Sai (SAI), USD Coin (USDC), Ox (ZRX) and Augur (REP). Although, one of the drawbacks for COMP token holders is that they can’t earn interest on the Compound pools, but the right to vote might be more important for some investors. A fixed amount of COMP is distributed to all Compound lenders and borrowers, which happens every 15 seconds, the time needed for an Ethereum block to be mined. The amount of COMP coins is obviously proportional to the interest accumulated by each asset. Every COMP coin represents 1 vote and anyone with 1% of the total COMP supply can submit and vote on proposals to change the protocol. If the community passes a governance change to the protocol, it will take two days to enter into effect, so anyone who has open positions before the changes go into effect can close them if they wish. This aims at keeping Compound entirely self-governing and decentralized.

Compound Token COMP Booming DeFi Indicates A Bright Future

The decentralized finance DeFi world has been expanding fast in recent year, but in 2020 it exploded, as all traditional assets became too risky to buy and hold, with the increased uncertainty across the globe, due to the Covid-19 and everything that followed. Ethereum is the main skeleton for the DeFi movement of recent years, enabling smart contracts where other decentralized blockchain applications (dApps) which offer a native cryptocurrency can be built.

Compound immediately attracted big names in this new industry as a DeFi new entrance, such as Coinbase Pro which acquired quite a few DeFi governance tokens. Coinbase Ventures funds came from an $8 million seed round, where Andreessen Horowitz of Polychain Capital and Bain Capital Ventures took part as well.

As the platform has gained traction, many other applications have integrated Compound into their offerings. Coinbase Custody and Anchorage both support COMP and cTokens. Since the COMP token was released, several other exchanges have jumped to list it, including Binance, FTX and Poloniex.

Until Compound released its own native token COMP, Maker (MKR) used to be the leader of the DeFi movement, remaining on top since this movement began. But, COMP took the DeFi market by storm, becoming the leader since June 2020 and has remained there since then. As this industry grows, Compound is only set to expand further and the COMP token will follow through, as we will explain in the technical analysis section below.

The Total Volume Locked (TVL) for DeFi was gathering momentum at a great speed in February and passed the amount of $1 billion at the height of the crypto surge. This figure represents the dollar value of assets closed in DeFi contracts and ended the financial year above $13 billion.

Vadim Koleoshkin, the chief operations officer at Zerion which is a DeFi interface provider, thinks that the current COMP hype is due to interest in a new type of share equity. Speaking to Cointelegraph, Koleoshkin believes that the launch of COMP is only the beginning of a broader shake-up in the DeFi space:

“Compound is one of the first Web 3.0 companies that became public, and COMP is cooler than traditional shares because it’s programmable. Tokens do not have yield, but Compound has a chance to become one of the most prominent players in the money market. The ability to participate in the governance of it may, therefore, be valuable.”

“Right now, we see a lot of new users coming in to explore what DeFi has to offer. From our recent findings, many users see DeFi as a viable alternative to services like Binance and Coinbase. Many more governance and DeFi tokens are going to launch soon, and trading venues like Uniswap, Kyber, and Balancer are ready to trade them.”

Monero Coin (XMR) Forecast for 2021: Will the XMR/USD Continue to Rise in 2021?

Ethereum (ETH) Price Prediction For 2021: Will Buyers Break 2017 Highs Soon?

Technical Analysis – Oversold COMP Set for Bullish Retracement

COMP’s price has undergone multiple bullish swings that are greater than the previous one since the beginning of 2021. Moreover, these are immediately followed by fluctuations, consolidation, and corrections. Taking this into account, COMP will have a competitive market in 2021.

COMP has done admirably over the last few days, as evidenced by the chart below. Furthermore, the COMP price has increased by nearly 330 percent in the last 12 months. If this trend continues, COMP may run with the bulls, breaking over its $826 resistance mark and reaching higher.

If investors abandon cryptocurrency, the bears may seize control and dethrone COMP from its upward position. In layman’s terms, the price of COMP might fall to about $300 and $202, indicating a bearish indication. Meanwhile, our long-term COMP price forecast for 2021 is positive. It is quite likely to outperform its current all-time high (ATH) of around $911.2. Furthermore, COMP has the potential to reach this level this year.

COMP/USD Weekly Timeframe – Double Top Breakout

COMP can reach $1,200 by the end of the year 2022, in case, the current bullish trend continues. Moreover, the first half of 2022 can see a tremendous rise, reaching $1,250. The growth can thereafter remain moderate, but no significant drops are forecast. With the impending, partnerships, and developments, reaching $1,200 is fairly ambitious in terms of pricing, but it is undeniably achievable in the near future. However, the COMP/USD now has the potential to drip until $202 before taking a bullish turn. Good luck!