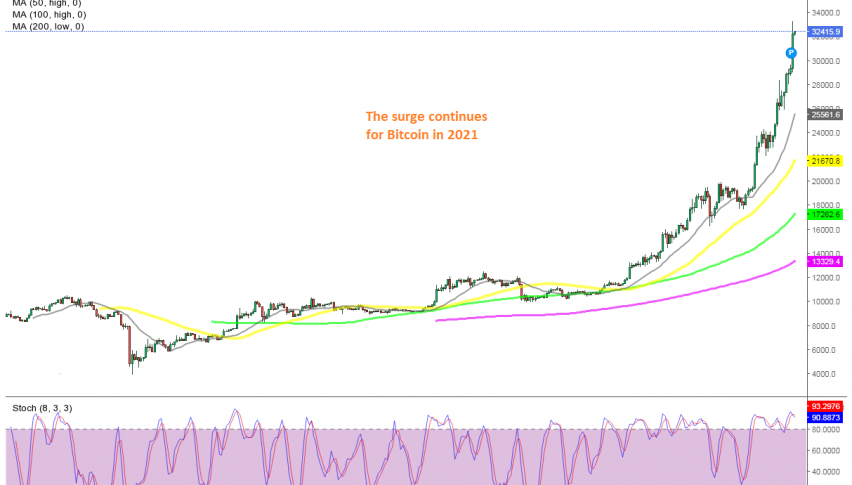

Bitcoin Gets A New Year Present, As It Breaks Above $ 30,000

Bitcoin has broken above $ 30,000 as a new year's present

Last year was great for cryptocurrencies; they started 2020 on a bullish footing, with Bitcoin increasing from around $ 7,000 in January until $ 13,200s by the end of February. But, as the coronavirus traveled to Europe, traders panicked and all markets plunged, apart from the USD, which surged as a global reserve currency. But, the tables flipped by the end of March and the USD turned bearish while most markets turned bullish.

Bitcoin reversed from the March crash which sent it more than $ 9,000 lower to $ 4,000 and hasn’t looked back since then. In fact, it has only been picking up pace as the months roll and the surge doesn’t seem to end. Bitcoin headed to $ 20,000 in November and after finding some resistance at that level which was the high in 2017, it eventually broke above it by the middle of December.

I though that we were going to see a pullback to $ 20,000 to test it if that zone would turn into support this time around, but buyers didn’t want to wait. They kept on piling on, since everyone wants a piece of the action, afraid they will miss on this big opportunity, which has turned into a self-fulfilling prophecy. The more people think it will increase, the more they pile on, which pushes the price even higher, and the snowball keeps rolling.

Bitcoin closed 2020 on a strong bullish momentum and it broke above the next big level at $ 30,000 without much resistance on the second day of 2021. Buyers pushed the price to $ 33.250s, so the door for the next target at $ 40,000 is open. But, the problem is that cryptos are going against their initial aim of being a means of transaction outside of the traditional main banking system, particularly Bitcoin.

Cryptocurrencies turned from risk assets to safe havens in 2020. But with the price above $ 30,000 for a single Bitcoin coin, the scalability problems increase. This issue will arise soon, although the crypto market is in the middle of the second massive bullish run and until the buying frenzy ends, they will keep surging as they were doing in 2020.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account