Tickmill Review

- Overview

- Tickmill Video, Visual Overview

- Fees, Spreads, and Commissions

- Deposits and Withdrawals

- Minimum Deposit and Account Types

- How to Open a Tickmill Account

- Islamic Account

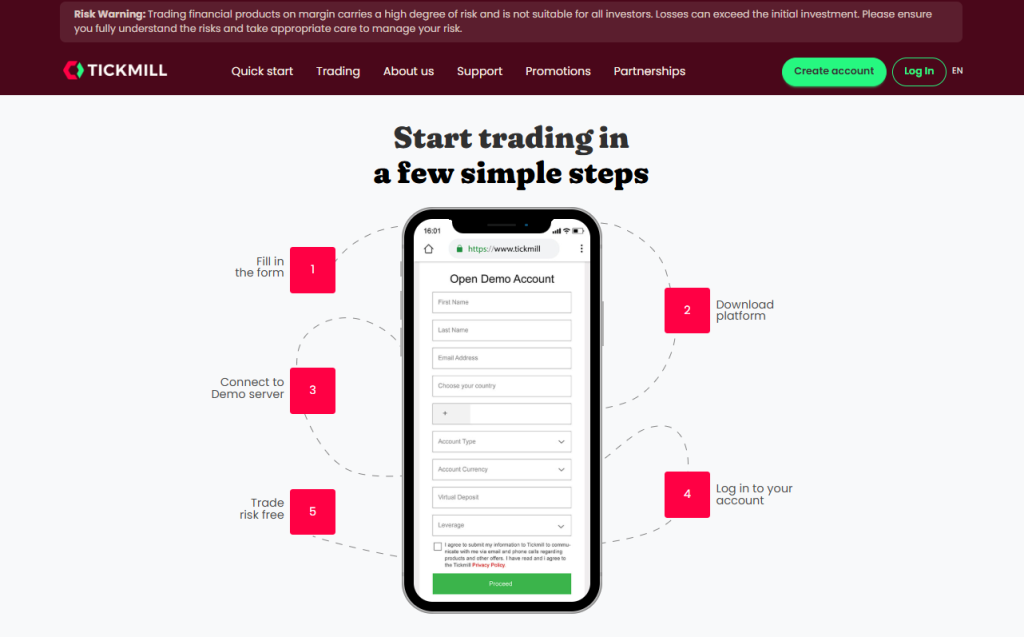

- Demo Account

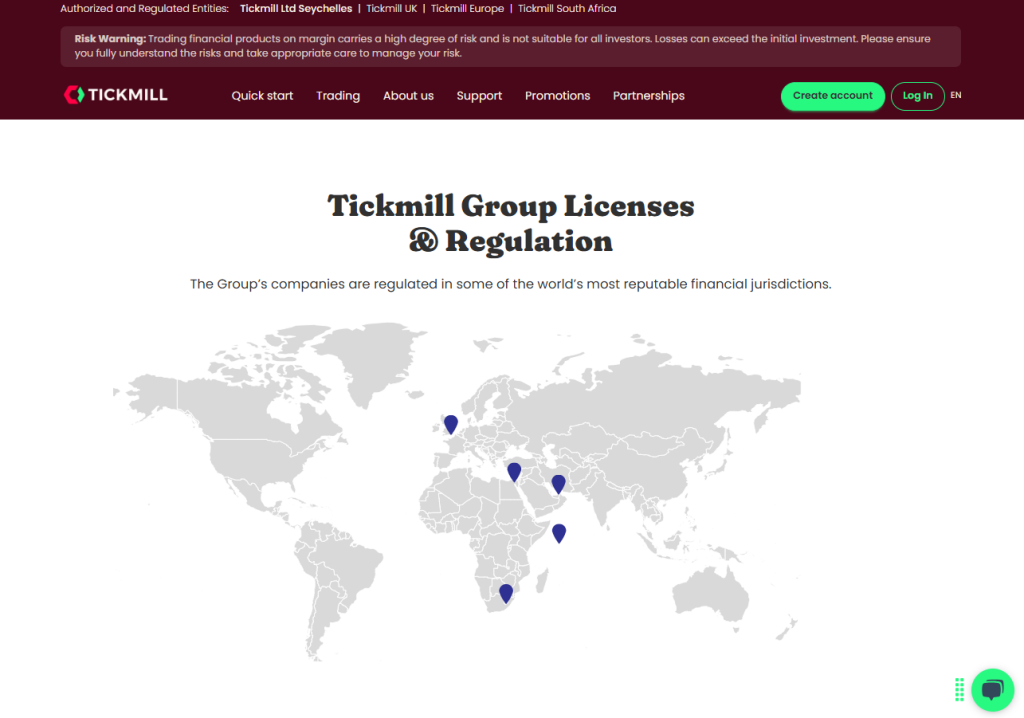

- Global Regulation, Oversight, and Trust

- $30 Welcome Account

- Trading Platforms and Tools

- Partner Up with Tickmill

- Tickmill Education Hub

- Customer Support

- Insights from Real Traders

- Trust Scores and User Ratings

- What Real Traders Want to Know!

- Tickmill vs Exness vs AvaTrade - A Comparison

- Pros and Cons

- In Conclusion

Tickmill is a reliable CFD broker known for ultra-tight spreads across 62+ trading instruments. Backed by regulation in one tier-1 and two tier-2 jurisdictions, it offers traders a secure and cost-effective trading environment.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Overview

Tickmill continues to evolve as a powerful global broker, offering access to 600+ CFDs with cutting-edge platforms, ultra-fast execution, and some of the most competitive trading conditions in the market for forex and CFD traders worldwide.

Frequently Asked Questions

Is Tickmill suitable for beginner traders?

Yes, Tickmill caters to beginners through its Classic Account with zero commissions and user-friendly MT4/MT5 platforms. In addition, its educational resources, like webinars, video tutorials, and articles, are designed to help new traders build foundational skills.

Which Tickmill account offers the best value for scalpers or day traders?

The Raw Account and TradingView Raw both provide 0.0 pip spreads and low commissions, making them ideal for scalpers and intraday traders seeking high precision and cost-efficiency across global markets.

Our Insights

Tickmill provides a strong combination of low-cost trading, advanced platforms, and international regulatory compliance. With flexible account options, ultra-tight spreads, and institutional-quality execution, it appeals to traders at every experience level.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Tickmill Video, Visual Overview

Discover Tickmill through engaging videos that showcase its trading platforms, features, and services. These visual guides provide a clear, concise introduction to the broker’s offerings, helping traders quickly understand how to navigate the platform and make the most of their trading experience.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Fees, Spreads, and Commissions

Tickmill stands out for its transparent, low-cost fee structure designed to meet the needs of beginners and professionals alike. With three core account types offering varying spreads and commission models, traders can align costs with their strategies.

| Account Type | Spreads From | Commission | Base Currencies |

| Classic Account | 1.6 pips | $0 | USD, EUR, GBP, ZAR |

| Raw Account | 0.0 pips | $3 per lot per side | USD, EUR, GBP, ZAR |

| TradingView Raw | 0.0 pips | $3.5 per lot per side | USD |

Frequently Asked Questions

What is the main difference between Tickmill’s Classic and Raw accounts?

The Classic Account charges no commissions but features wider spreads starting from 1.6 pips. In contrast, the Raw Account offers ultra-tight 0.0 pip spreads with a low $3 per lot per side commission, ideal for active traders.

Does Tickmill charge hidden fees?

No, Tickmill maintains a transparent fee model. There are no hidden charges beyond spreads and commissions. Account holders may incur overnight swap fees unless using a swap-free Islamic account, and deposits/withdrawals are clearly outlined.

Our Insights

Tickmill features highly competitive pricing with ultra-low spreads, commission-free accounts, and adjustable leverage. Catering to scalpers, swing traders, and long-term investors alike, it offers account types suited to a variety of trading styles and cost preferences.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Deposits and Withdrawals

Tickmill empowers traders with a range of instant and secure deposit and withdrawal options. With no hidden fees, fast processing times, and support for multiple currencies, fund management becomes seamless, helping you focus more on trading and less on logistics.

| Method | Min. Deposit | Processing Time (Deposit) | Commission |

| Bank Transfer | 100 USD | Within 1 Working Day | None |

| Crypto Payments | 100 USD | Instant (24/7) | None |

| Visa / Mastercard | 100 USD | Instant* | None |

| Skrill / Neteller | 100 USD | Instant* | None |

| FasaPay | 100 USD | Instant* | None |

| UnionPay | ¥700 / 100 USD | Instant* | None |

Frequently Asked Questions

Does Tickmill charge any deposit or withdrawal fees?

No, Tickmill does not charge deposit or withdrawal fees. Deposits over $5,000 via bank wire may qualify for reimbursement of transfer costs up to $100 when documentation is provided to support the claim.

How long do deposits and withdrawals take to process?

Most deposits are processed instantly, while withdrawals are completed within one working day. Bank transfers may take up to 24 hours, while e-wallets and cards typically reflect much faster.

Our Insights

Tickmill offers fee-free deposits and withdrawals with fast, dependable processing, giving traders greater financial flexibility. Whether funding via crypto, cards, e-wallets, or bank transfers, clients enjoy a seamless and reliable payment experience.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Minimum Deposit and Account Types

Tickmill offers a range of account types to match every trading style, whether you’re a beginner, a scalper, or a high-frequency day trader. Each account delivers transparent pricing, flexible leverage, and access to powerful platforms like MT4, MT5, and TradingView.

Frequently Asked Questions

Which Tickmill account is best for beginners?

The Classic Account is ideal for new traders. It offers commission-free trading, simplified cost structures, and access to the MT4 and MT5 platforms with a low minimum deposit starting from just $100.

What’s the difference between Raw and TradingView Raw accounts?

Both accounts offer 0.0 pip spreads, but TradingView Raw comes with a slightly higher commission of $3.5 per lot per side. It is tailored for users who prefer the TradingView and Tickmill Trader platforms with enhanced charting tools.

Our Insights

Tickmill’s account offerings cater to a broad range of traders. Whether you seek zero commissions, ultra-tight spreads, or advanced charting tools, Tickmill delivers reliable account options to match various trading goals and strategies.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

How to Open a Tickmill Account

1. Step 1: Account Creation

To start, click the green “Create Account” button located at the top right of the Tickmill homepage.

2. Step 2: Registration

Fill out the registration form, providing details such as your country of residence and client type.

3. Step 3: Confirmation

After submitting the form, you will receive a confirmation email to verify your account creation.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Islamic Account

Tickmill offers swap-free Islamic accounts for Muslim traders who seek halal trading conditions without compromising on features. These accounts remove overnight interest while maintaining the same spreads, leverage, and execution quality as standard account types.

| Account Types | Open an Account | Swap-Free Option | Platforms | Fees Charged |

| Classic Account | Yes | Yes | MT4 MT5 | Handling fees (after 40+ days for select pairs) |

| Raw Account | Yes | Yes | MT4 MT5 | Handling fees (after grace period) |

| Trading Instruments | Yes | Forex Stocks Crypto Indices Commodities Bonds | MT4 MT5 | Varies by asset and days held |

Frequently Asked Questions

What is a Tickmill Islamic (Swap-Free) Account?

A Tickmill Islamic Account is a Sharia-compliant trading account that charges no interest (swap) on overnight positions. It supports both Classic and Raw account types, with identical spreads, leverage, and execution speeds as regular accounts.

Are there any extra fees on Islamic accounts?

While no swap is charged, Tickmill applies a fixed handling fee on specific instruments after a grace period. These fees are transparent, charged per lot, and only begin after a few nights of holding a position open.

Our Insights

Tickmill offers a genuine Islamic trading account that aligns with religious principles while granting access to professional trading tools. Featuring no swaps, competitive spreads, and efficient execution, it serves as a reliable choice for Muslim traders worldwide.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Demo Account

Tickmill’s free demo account offers a realistic, risk-free gateway into the world of Forex and CFD trading. With access to real-time pricing, advanced platforms, and 180+ instruments, it’s the ideal training ground for beginner and experienced traders alike.

| Account | Demo |

| Platform | MT4 MT5 |

| Virtual Deposit | Customisable |

| Instruments Available | 180+ CFDs across 6 asset classes |

| Max Demo Accounts per User | 7 per email |

| Open an Account |

Frequently Asked Questions

What can I trade with a Tickmill demo account?

You can trade over 180 instruments, including Forex, Commodities, Stocks, Indices, Bonds, and Cryptocurrencies. The demo environment mirrors live conditions, allowing you to test strategies in real market scenarios without financial risk.

Does the demo account expire or have limitations?

Each user can open up to 7 demo accounts per registered email. While there’s no immediate expiration, extended inactivity may result in account deactivation. It’s best used consistently for skill-building and platform exploration.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Global Regulation, Oversight, and Trust

Tickmill operates under strict supervision from multiple tier-1 and tier-2 regulatory authorities, offering clients a secure and transparent trading environment. With licenses in the UK, EU, South Africa, and Seychelles, the broker meets high international standards for investor protection.

| Entity | Regulator | Region | License No. |

| Tickmill UK Ltd | 🇬🇧 FCA | 🇬🇧 United Kingdom | 717270 |

| Tickmill Europe Ltd | 🇨🇾 CySEC | 🇨🇾 Cyprus | 278/15 |

| Tickmill Ltd | 🇸🇨 FSA | 🇸🇨 Seychelles | SD008 |

| Tickmill South Africa | 🇿🇦 FSCA | 🇿🇦 South Africa | FSP 49464 |

| Tickmill (Rep. Office) | 🇦🇪 DFSA | 🇦🇪 UAE | Ref No. F007663 |

Is Tickmill a regulated and safe broker to trade with?

Yes. Tickmill is licensed by leading regulators, including the FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), and DFSA (UAE Rep Office). These licenses ensure strict compliance with financial laws and client protection standards.

Which compensation schemes protect Tickmill clients?

Clients of Tickmill UK are protected by the FSCS (up to £85,000), and Tickmill Europe clients are covered under the ICF. These schemes compensate eligible clients if the broker becomes insolvent or cannot meet financial obligations.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Safety Beyond the Trade

Tickmill goes beyond standard regulatory requirements to safeguard client funds. Through insured balances, segregated accounts, and negative balance protection, traders can operate with peace of mind knowing their capital is protected at every level.

| Protection Measure | Details |

| Insurance Coverage | $20,000 – $1,000,000 via Lloyd’s (Seychelles) |

| Segregated Client Accounts | Yes, in reputable international banks |

| Negative Balance Protection | Yes – cannot lose more than your deposit |

| Financial Regulation | FCA CySEC FSCA FSA |

How does Tickmill protect client deposits?

Tickmill keeps all client funds in segregated bank accounts, ensuring they’re never mixed with company capital. These accounts are held with reputable financial institutions, further protecting traders against financial mismanagement or misuse.

Is my money insured with Tickmill?

Yes. Tickmill Seychelles clients benefit from fund insurance provided by Lloyd’s, covering amounts from $20,000 to $1,000,000 in case of company insolvency. This is in addition to regulatory protections like FSCS and ICF for other entities.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Frequently Asked Questions

Is Tickmill a regulated and safe broker to trade with?

Absolutely. Tickmill holds licenses from top regulatory bodies, including the FCA (UK), CySEC (Cyprus), FSCA (South Africa), and FSA (Seychelles), along with DFSA representation in the UAE. This ensures client safety, compliance, and legal transparency.

Which compensation schemes protect Tickmill clients?

Tickmill UK clients are covered by the FSCS up to £85,000. Tickmill Europe clients benefit from the ICF, which offers compensation if the broker becomes insolvent or cannot meet its financial obligations.

Our Insights

Tickmill emphasizes investor protection through robust global regulation, client fund safeguards, and a transparent operational structure. Catering to both beginners and professional traders, it provides security that exceeds standard industry requirements.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

$30 Welcome Account

Tickmill’s $30 Welcome Account lets new traders experience real market conditions without risking personal funds. With no deposit required, fast execution, and access to live trading tools, it’s the perfect way to get started.

| Feature | Details |

| Starting Balance | $30 (complimentary by Tickmill) |

| Account Type | Raw Account replica |

| Validity Period | 60 days active trading + 14-day grace |

| Max Withdrawable Profit | $100 (after $100 deposit) |

Frequently Asked Questions

What is the Tickmill $30 Welcome Account?

The Welcome Account is a no-deposit trading account offered by Tickmill Ltd (FSA SC regulated), giving new clients $30 in complimentary funds to experience live trading for 60 days. Profits up to $100 can be withdrawn after meeting the conditions.

Can I withdraw profits from the Welcome Account?

Yes. You can transfer between $30–$100 in profits to your live Wallet account after registering, verifying your identity, and depositing at least $100. The bonus itself cannot be withdrawn—only earned profits.

Our Insights

Tickmill’s Welcome Account is an excellent option for beginners seeking real trading experience with zero risk. It allows traders to test the broker’s services, platforms, and trading conditions without depositing any capital upfront.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Trading Platforms and Tools

Tickmill provides a robust lineup of trading platforms, including MT4, MT5, TradingView, and Tickmill Trader, designed for traders of all skill levels. With low spreads, automation support, and multi-device access, each tool enhances efficiency and market connectivity.

| Platform | Best For | Key Features | Devices |

| MetaTrader 4 | Classic strategy traders | EAs fast execution MQL4 scripting | Windows Mac iOS Android |

| MetaTrader 5 | Advanced strategy traders | More indicators economic calendar MQL5 | Windows Mac iOS Android |

| TradingView | Chart-focused users | 100k+ strategies community direct trading | Web Desktop Mobile |

| Tickmill Trader | Mobile-first traders | Spreads from 0.0 60+ indicators biometric login | iOS Android WebTrader |

TradingView

Tickmill brings powerful charting and trading capabilities to life through its integration with TradingView. This combination offers innovative tools, a vibrant trading community, and competitive conditions like 0.0 pip spreads and leverage up to 1:1000.

Can I trade directly from TradingView with Tickmill?

Yes. By linking your Tickmill Trader Raw account to TradingView, you can trade CFDs directly from the TradingView interface. Enjoy seamless execution with low spreads and competitive commissions.

Is TradingView free when used with Tickmill?

Accessing TradingView’s trading functionality with Tickmill is free. While advanced TradingView features may require a paid subscription, placing trades through your Tickmill account incurs no additional platform fee.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

MetaTrader 5

MetaTrader 5 (MT5) at Tickmill is a next-gen platform built for serious traders. With improved speed, deeper analytical tools, and unmatched flexibility, it empowers users to explore a wider range of markets and trade more intelligently than ever.

What makes MT5 at Tickmill better than MT4?

MT5 offers more timeframes, technical indicators, and pending order types than MT4. It supports multi-threaded strategy testing, an economic calendar, and unlimited symbols, giving you deeper insights and better automation capabilities.

Can I use MT5 across all my devices?

Yes! Tickmill’s MT5 platform is available on Windows, macOS, Android, iOS, and WebTrader. This ensures full accessibility and seamless trading whether you’re on desktop, tablet, or smartphone – anytime, anywhere.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

MetaTrader 4

Tickmill’s MetaTrader 4 platform delivers a streamlined, secure, and fully customisable trading experience. Backed by years of industry trust, MT4 offers unparalleled functionality, mobile compatibility, and automation for traders seeking efficiency, flexibility, and performance across global markets.

What makes Tickmill’s MT4 platform different from other brokers?

Tickmill enhances the classic MT4 platform with ultra-fast execution, no partial fills, VPS support for EAs, and multilingual accessibility. Their custom-built MT4 for Mac and mobile apps ensure seamless trading across devices, boosting overall reliability and user experience.

Can I use automated trading strategies with Tickmill MT4?

Yes. Tickmill MT4 supports expert advisors (EAs), custom indicators, and algorithmic trading using MQL4. Traders can even buy or sell EAs via the MetaTrader Marketplace and integrate them seamlessly using VPS hosting for 24/7 trading automation.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Tickmill Trader

Tickmill’s proprietary Trader platform – available via mobile app or WebTrader – offers seamless access to 100+ CFD instruments with spreads from 0.0, leverage up to 1:1000, and powerful charting tools designed for active traders on the move.

What markets can I trade on the Tickmill Trader platform?

Tickmill Trader allows you to trade CFDs across Forex, Indices, Commodities, Cryptocurrencies, and Bonds, offering low spreads from 0.0 and leverage up to 1:1000 for an efficient and diversified trading experience.

Is Tickmill Trader available as both a mobile app and a web platform?

Yes, Tickmill Trader is available for iOS and Android devices, including APK download, and also as a WebTrader. Both options offer powerful tools, real-time data, custom watchlists, and biometric login for secure, flexible trading.

Frequently Asked Questions

Can I trade directly on TradingView with Tickmill?

Yes. By linking a Tickmill Trader Raw account, you can place CFD trades directly within the TradingView interface. Enjoy competitive spreads, real-time execution, and no additional fees for using the platform.

Does Tickmill support automated trading on MetaTrader platforms?

Absolutely. Tickmill MT4 and MT5 both support automated trading through Expert Advisors (EAs), allowing full customization of trading strategies. VPS hosting ensures 24/7 uptime and ultra-low latency for serious automation users.

Our Insights

Tickmill’s platform offerings provide a premium trading experience for both beginners and experienced traders across all devices. With MT4 automation and TradingView social insights, it blends powerful functionality, flexibility, and ultra-low-cost trading.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Partner Up with Tickmill

Tickmill’s partnership programs empower individuals and businesses to earn substantial commissions by referring traders. With zero setup costs, competitive payouts, and full marketing support, both the IB and Affiliate programs present powerful, scalable income opportunities for serious partners.

| Feature | Introducing Broker (IB) | Affiliate Program | Cost to Join |

| Commission Type | Spread share Lot-based | CPA (per qualified trader) | Free |

| Tracking Tools | IB Portal | CellXpert | Free |

| Payouts | Up to 55% or $2.5 per lot | Fixed CPA per conversion | Free |

Introducing Broker Program

Tickmill’s Introducing Broker (IB) program offers individuals and companies the opportunity to earn commissions by referring new traders. With competitive payouts, marketing support, and real-time tracking, it’s an ideal way to generate income online.

| Feature | Details | Classic Account | Raw Account |

| Commission Type | Spread revenue / per-lot | Up to 55% of spread | $2.5 per traded lot |

| Commission on CFDs | Based on notional value | 0.001% (Stocks/ETFs) | 0.002% (Crypto) |

| Referral Discount | On client commissions | Not applicable | 5% discount for referrals |

| Sub-IB System | Multi-tier earnings | Yes | Yes |

Commission is calculated on closed trades. Marketing tools, IB portal access, and referral tracking are included with registration.

How much can I earn as a Tickmill Introducing Broker?

As a Tickmill IB, you can earn up to 55% of spread revenue from Classic accounts or $2.5 per lot traded on Raw accounts. You can also earn from stocks, indices, commodities, and crypto based on notional trade value.

Is there a cost to become an Introducing Broker with Tickmill?

No, there is no cost to register. You can join the program online, verify your profile, access marketing tools, and start referring traders immediately, making it an accessible opportunity for individuals and businesses alike.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Affiliate Program

The Tickmill Affiliate Program is designed for individuals and businesses looking to earn high commissions by referring new traders. With transparent terms, global reach, and top-tier trading conditions, it’s built for serious marketers.

What is the Tickmill Affiliate Program, and how does it work?

Tickmill’s Affiliate Program allows you to earn CPA payouts by referring traders to a regulated, multi-asset broker. Simply register, share your referral link, and earn commissions for every qualified trader who joins.

What support and tools are provided to affiliates?

Affiliates receive access to CellXpert tracking, a dedicated manager, customizable marketing tools, and performance analytics. Plus, Tickmill offers multilingual resources to help you convert traffic more effectively and boost your affiliate success.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Frequently Asked Questions

How much can Introducing Brokers earn with Tickmill?

Tickmill IBs can earn up to 55% of spread revenue from Classic accounts or $2.5 per traded lot on Raw accounts. Earnings also apply to other assets like stocks, indices, crypto, and commodities based on notional volumes.

Is there a cost to join Tickmill’s Affiliate or IB program?

No. Both the IB and Affiliate programs are completely free to join. After a simple registration and verification process, partners get access to referral tools, tracking platforms, and support, all at no cost.

Our Insights

Whether you’re a content creator, trading educator, or financial marketer, Tickmill’s partnership programs offer generous payouts, transparency, and professional tools. It’s a low-risk, high-potential way to monetize your audience and expand your earning opportunities in the trading world.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Tickmill Education Hub

Tickmill delivers a comprehensive education suite, including free eBooks, webinars, seminars, video tutorials, and advanced tools. Designed for all skill levels, this content empowers traders with insights, strategies, and confidence before entering the markets.

| Resource Type | Key Features | Target Audience | Access Format |

| eBooks | Fibonacci risk/cost strategy guides | Beginner to intermediate | PDF download |

| Webinars Seminars | Live chart analysis, market insights in multiple languages | All levels | Online & in-person |

| Video Tutorials | Platform walkthroughs (MT4/MT5) trading styles analysis | Beginner to advanced | On-demand video |

| Infographics Blog | Glossaries market insights trade tips | All levels | Web articles & visuals |

Frequently Asked Questions

What educational formats does Tickmill offer?

Tickmill provides a variety of formats: multilingual webinars and in-person seminars, step-by-step video tutorials, downloadable eBooks on technical analysis and risk management, plus infographics and blog articles.

Who benefits most from Tickmill’s education materials?

Both beginners and advanced traders benefit. Beginners can learn basics like entry orders and pips, while experienced traders explore complex topics like futures trading, strategy backtesting, and CQG video guides.

Our Insights

Tickmill’s well-rounded educational content, from eBooks to interactive webinars, provides traders with actionable knowledge and practical tools. Whether you’re just starting or refining strategies, their resources offer significant value in developing effective trading skills.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Customer Support

Tickmill ensures easy, multilingual access to its support teams through local offices and global phone lines. Whether you’re a new or existing trader, assistance is available across multiple time zones, with reliable service and regulated entity transparency.

Frequently Asked Questions

How can I contact Tickmill support?

You can reach Tickmill via phone or email. The support email is monitored during business hours and promises replies within 24 hours. You can also submit queries through their contact form.

Does Tickmill offer local support in different countries?

Yes. Tickmill operates support services and offices in key regions like Seychelles and South Africa, with designated numbers and regulated entity details for country-specific assistance.

Our Insights

Tickmill’s regional offices and responsive customer service ensure global traders can get timely assistance. Clear contact points, regulatory backing, and multilingual support options create a reliable foundation for secure and confident trading.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

Tickmill’s withdrawal process is fast and hassle-free. The tight spreads and excellent trading conditions make it a top broker. I’ve been impressed with the platform’s performance and customer support.

Dennis

⭐⭐⭐⭐⭐

I feel comfortable using the Tickmill broker; the execution speed is very good, so there is no need to hesitate in opening and closing transactions. The spread is low; hopefully, the best service quality will be maintained.

D. Tio

⭐⭐⭐

I just had the most pleasant experience with Tickmill. The next morning, I had an email stating my negative balance had been cleared, and my entire balance, as it was just before the jump, was refunded. Now I’m happily trading as per normal.

Kavish

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Trust Scores and User Ratings

| Platform | Rating (5) | Total Reviews | Key Highlights |

| Trustpilot | 3.6 | 794 | 65% 5-star reviews; praised for low fees and support |

| TradingView | 4.7 | 395 | Commended for low spreads and execution speed |

| App Store (UK) | 5 | 3 | Users highlight ease of use and clear sign-up process |

| App Store (ZA) | 4.8 | 6 | Positive feedback on competitive commissions and fast execution |

| Reviews.io | 2.5 | 218 | Mixed reviews; some concerns about withdrawals |

| ForexPeaceArmy | Not specified | Not specified | Discussions on support responsiveness and trading conditions |

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

What Real Traders Want to Know!

Q: What trading instruments are available on Tickmill?

Q: Can I trade with Tickmill using a mobile device?

Q: What leverage is available with Tickmill accounts?

Q: How fast is trade execution on Tickmill?

Q: What types of accounts does Tickmill offer?

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Tickmill vs Exness vs AvaTrade – A Comparison

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong regulation | Limited platform options |

| Full MetaTrader suite | Less competitive pricing on Classic account |

| Low minimum deposit | Commission fees on Raw Accounts |

| Competitive spreads | Limited educational resources |

In Conclusion

Tickmill offers a wide range of financial instruments, seamlessly catering to both retail and institutional traders. Moreover, with flexible account types and low-cost trading, it ensures a tailored experience, making Tickmill a trusted and efficient broker choice.

Tickmill maintains local offices and offers dedicated customer support across multiple regions to ensure seamless service and quick responses for traders worldwide.

- 🇸🇨 Seychelles

- 🇿🇦 South Africa

- 🇲🇾 Malaysia

- 🇨🇾 Cyprus

- 🇬🇧 United Kingdom

Each office comes with its multilingual support team, regional phone lines, and office addresses, ensuring clients receive personalized assistance tailored to their locality.

Faq

The minimum deposit to open an account with Tickmill is just $100, which makes it highly accessible for new traders. Additionally, this low entry point allows beginners to start trading without a significant financial commitment.

Yes, Tickmill is regulated by the Financial Conduct Authority (FCA) in the UK, CySEC in Cyprus, and the FSA in Seychelles. As a result, it offers a secure and compliant trading environment across multiple jurisdictions.

Tickmill supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular platforms for Forex and CFD trading. Therefore, traders benefit from advanced tools, seamless execution, and industry-standard trading technology.

Tickmill offers Islamic accounts that are fully compliant with Islamic finance principles. As a result, these accounts are free from interest-based fees, providing a Shariah-friendly trading solution for Muslim traders around the world.

- Overview

- Tickmill Video, Visual Overview

- Fees, Spreads, and Commissions

- Deposits and Withdrawals

- Minimum Deposit and Account Types

- How to Open a Tickmill Account

- Islamic Account

- Demo Account

- Global Regulation, Oversight, and Trust

- $30 Welcome Account

- Trading Platforms and Tools

- Partner Up with Tickmill

- Tickmill Education Hub

- Customer Support

- Insights from Real Traders

- Trust Scores and User Ratings

- What Real Traders Want to Know!

- Tickmill vs Exness vs AvaTrade - A Comparison

- Pros and Cons

- In Conclusion