Pepperstone Review

- Overview

- Pepperstone Visual, Video Overview

- The Pepperstone Advantage

- Fees, Spreads, and Commissions

- Tailored Trading Accounts and Tools

- How to Open a Pepperstone Account

- Demo Account

- Trusted Safety and Security

- Powerful Trading Platforms and Advanced Tools

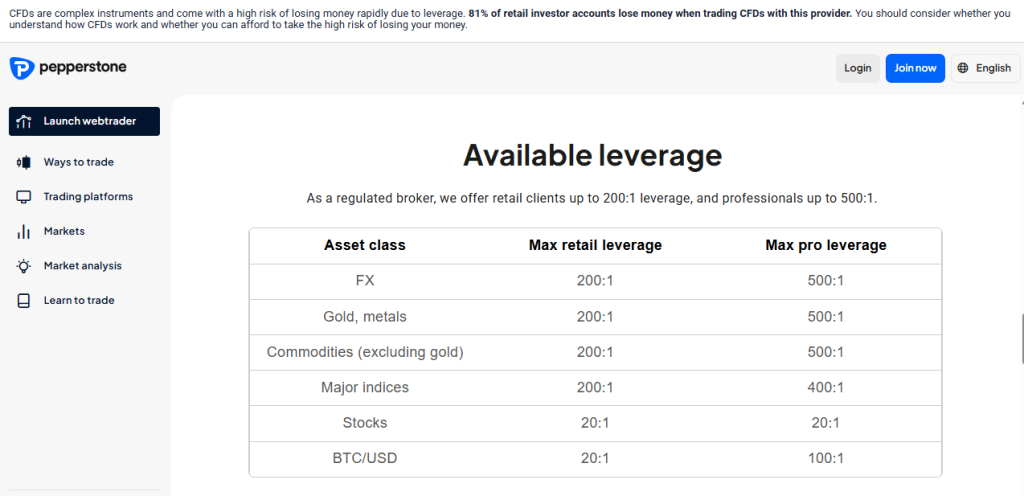

- Leverage and Margin

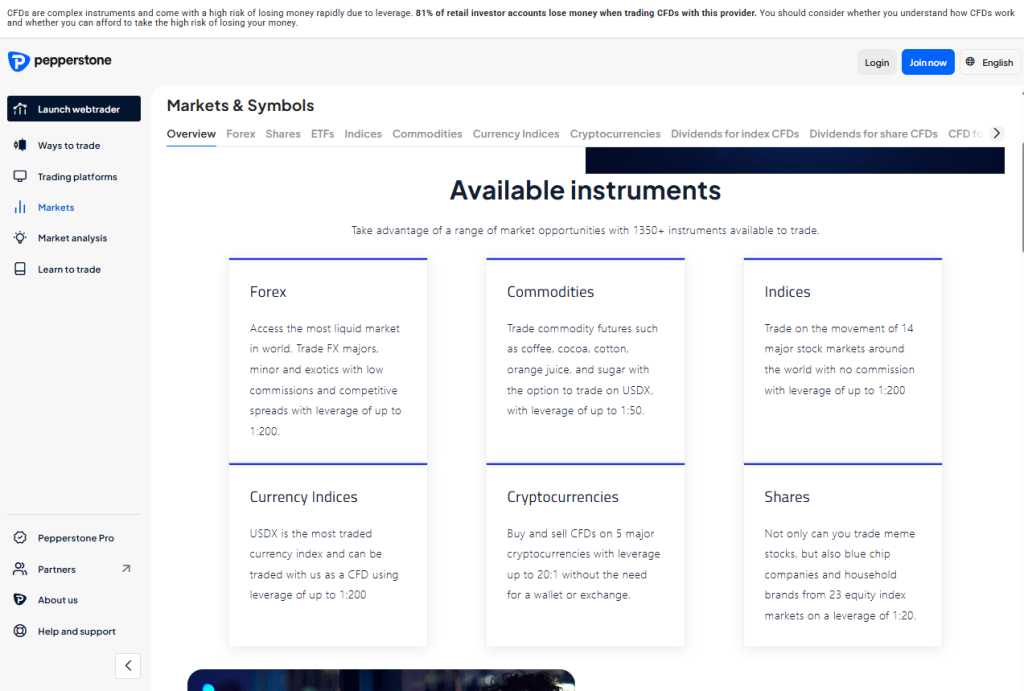

- Markets Available for Trade

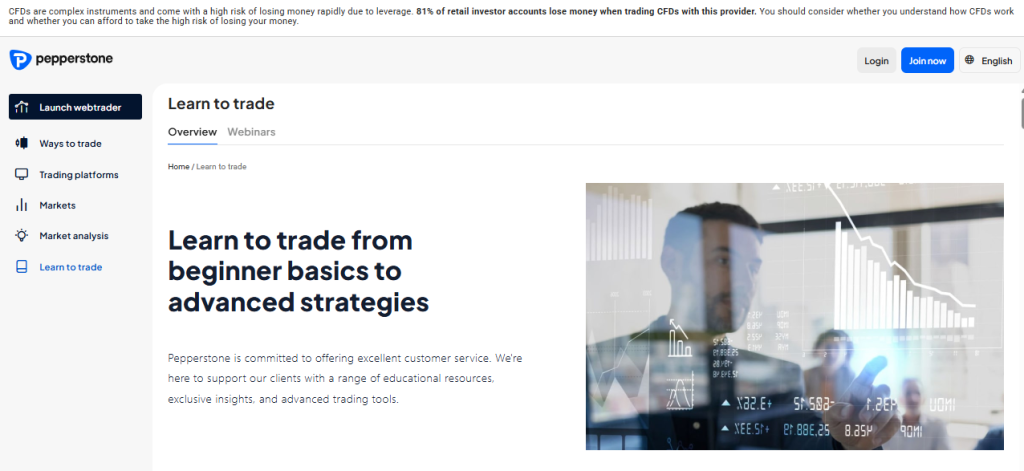

- Education and Resources

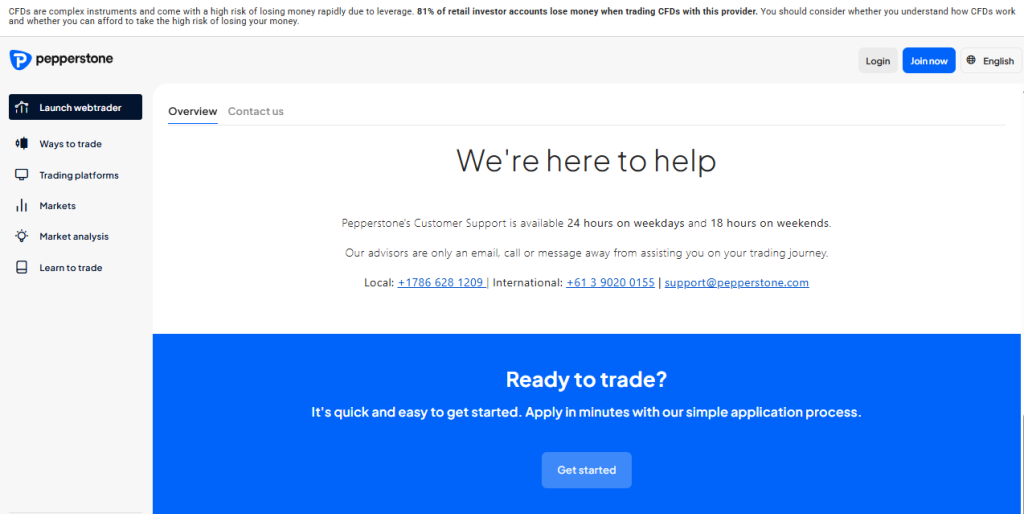

- Customer Support and Help

- Insights from Real Traders

- Employee Reviews and Workforce Sentiment

- Discussions and Forums - What Real Traders Say About Pepperstone

- What Traders Want and Need to Know about Pepperstone - Quick Q&A

- Pepperstone vs AvaTrade vs Octa - A Comparison

- Pros and Cons

- In Conclusion

Pepperstone is a reliable broker offering highly competitive spreads on Contracts for Difference (CFDs). With over 1,200 trading instruments available and an impressive trust score of 98/100, it’s a top choice for traders.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Overview

Pepperstone is a globally recognized fintech broker, created by traders with traders in mind. Established in Australia, it specializes in low-cost, high-speed trading and supports more than 400,000 clients around the world. Known for its strong regulatory oversight and award-winning service, it’s a top pick for dedicated market participants.

Frequently Asked Questions

What makes Pepperstone different from other forex brokers?

Pepperstone combines advanced technology with tight spreads, lightning-fast execution, and premium customer support. Its multi-regulated status and high daily trading volumes highlight its global reach and the trust it has earned among traders.

Founded by seasoned traders, Pepperstone has a deep understanding of what professionals require to thrive in the markets.

Is Pepperstone regulated and safe to trade with?

Yes, Pepperstone is licensed by leading financial regulators, including ASIC (Australia), FCA (UK), BaFin (Germany), DFSA (UAE), and others. To ensure client protection, it holds funds in segregated accounts with Tier 1 banks and provides negative balance protection—offering a secure and dependable trading environment for all clients.

Our Insights

Pepperstone has grown from a trader-led startup into one of the world’s leading forex brokers. Its strong regulatory oversight, daily trading volume of $12.55 billion, and commitment to exceptional customer service underscore its credibility.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Pepperstone Visual, Video Overview

Explore Pepperstone through quick, engaging videos and visuals that bring the platform to life. Whether it’s platform walkthroughs or trading tutorials, these resources provide an interactive way to discover the broker’s tools, features, and global trading experience.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

The Pepperstone Advantage

Pepperstone has grown into a global leader in online trading by combining fintech innovation with a trader-centric approach. Launched in 2010 by experienced traders, it now processes over $12.5 billion in daily trading volume and supports a client base of more than 400,000 worldwide.

Its solid reputation is built on trusted regulatory oversight, tier-1 bank fund segregation, and award-winning customer service.

| Feature | Details |

| Founded | 2010 Melbourne Australia |

| Global Clients | 400,000+ traders |

| Daily Trading Volume | US$12.55 Billion |

| Regulations | 🇦🇺 ASIC 🇬🇧 FCA 🇩🇪 BaFin 🇦🇪 DFSA 🇨🇾 CySEC 🇧🇸 SCB 🇰🇪 CMA |

Frequently Asked Questions

What sets Pepperstone apart from other forex brokers?

Pepperstone’s advantage lies in its trader-first foundation, lightning-fast execution, and consistently low spreads. Built by traders who understood the real-world challenges of the market, it stands out from many traditional brokers.

Is my money safe with Pepperstone?

Yes, Pepperstone is licensed by leading regulatory bodies such as ASIC, FCA, CySEC, DFSA, and BaFin. It safeguards client funds by keeping them in segregated Tier 1 bank accounts and provides negative balance protection—offering an added layer of security even during extreme market volatility.

Our Insights

Pepperstone isn’t just another forex broker – it’s a finely tuned trading ecosystem built for serious traders. With decades of combined experience, strict regulations, and a sharp focus on client success, it continues to earn accolades globally.

Its scale, transparency, and speed position it among the best in the industry.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Fees, Spreads, and Commissions

Pepperstone offers traders ultra-tight spreads, low-latency execution, and competitive commissions on top-tier platforms. By sourcing liquidity from leading banks, it delivers deep market access with minimal slippage.

Whether you’re scalping, day trading, or swing trading, Pepperstone’s transparent pricing keeps your trading costs low and predictable.

| Instrument | Razor Avg Spread | Standard Avg Spread | Commission (Razor) |

| EUR/USD | 0.1 pips | 1.1 pips | $7 round turn |

| GBP/USD | 0.2 pips | 1.2 pips | £4.50 round turn |

| USD/JPY | 0.2 pips | 1.2 pips | ¥607 round turn |

| AUD/USD | 0.1 pips | 1.1 pips | A$7 round turn |

Frequently Asked Questions

What type of trading spreads does Pepperstone offer?

Pepperstone offers both Razor and Standard account types to suit different trading styles. Razor accounts feature spreads from 0.0 pips on major pairs like EUR/USD, making them ideal for scalpers and high-frequency traders.

Standard accounts, on the other hand, include the spread with no added commission—perfect for beginners or casual traders who prefer a simpler pricing model.

How are commissions charged on Pepperstone accounts?

Commissions on Razor accounts apply only when trading forex CFDs, with rates depending on the account currency, starting at $7 per round turn (standard lot). These accounts are supported on MT4, MT5, and cTrader platforms, and commissions for micro lot trades are adjusted accordingly.

Our Insights

Pepperstone offers a competitive advantage with tight spreads, clear commissions, and professional-grade execution speeds. With a variety of pricing models and platform options, traders can select the setup that aligns perfectly with their trading style.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

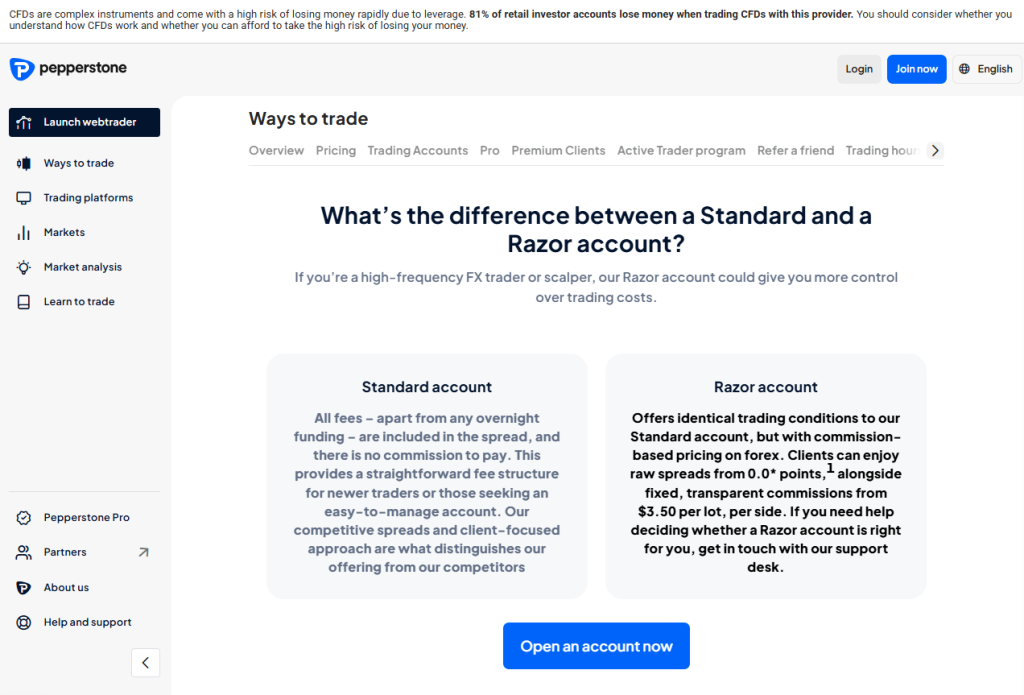

Tailored Trading Accounts and Tools

Pepperstone offers customized trading accounts designed for different strategies and skill levels. With ultra-competitive spreads, low minimum deposits, and access to five top-tier platforms, traders can choose between the simplicity of Standard accounts or the precision of Razor accounts.

Bolstered by risk management tools and 24/5 customer support, the platform ensures a smooth and efficient trading experience.

Frequently Asked Questions

What are the main differences between Pepperstone’s Standard and Razor accounts?

The Standard account is perfect for beginners, featuring no commissions and spreads starting from 0.4 pips. The Razor account caters to high-frequency traders and scalpers, with raw spreads from 0.0 pips and low, fixed commissions starting at $2.96 per lot, per side. Both account types provide access to the same markets and platforms.

Can I trade all available instruments on any Pepperstone account?

Yes, regardless of whether you choose Standard or Razor, you’ll have access to a wide range of 1,444 instruments, including 93 forex pairs, 26 indices, 40 commodities, 1,162 shares, and 95 ETFs.

Both account types support trading on MetaTrader 4/5, cTrader, TradingView, and Pepperstone’s proprietary platform.

Our Insights

Pepperstone offers versatile account types that cater to both beginner and experienced traders. With clear pricing, advanced platform choices, and institutional-grade spreads, traders enjoy a strong infrastructure and global support.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

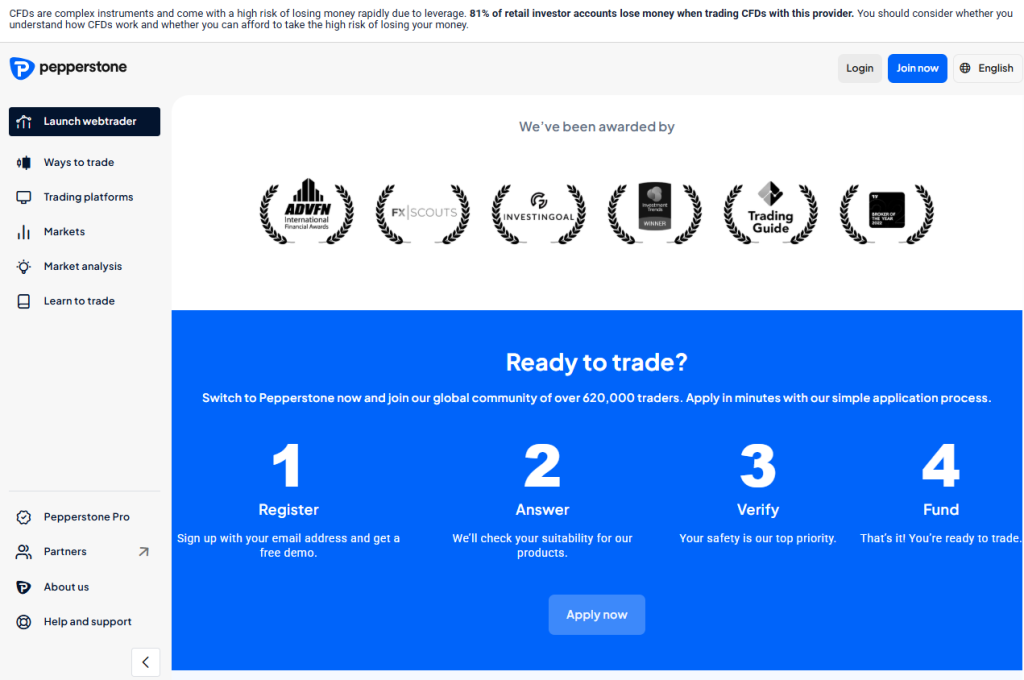

How to Open a Pepperstone Account

1. Step 1: Register Online

Visit the Pepperstone website and click “Join Now.” Sign up using your email address and create a secure password. You can also explore the platform first using a free demo account.

2. Step 2: Complete the Application

Answer a few questions about your trading experience and financial background. This is to assess your suitability for trading leveraged products and ensure compliance with regulatory requirements.

3. Step 3: Verify Your Identity

Upload valid identification documents (such as a passport or national ID) and proof of address. Pepperstone prioritizes your safety and complies with international financial security standards.

4. Step 4: Choose an Account Type

Select between the Standard and Razor CFD accounts:

- Standard: No commission, all fees built into the spread – ideal for beginners.

- Razor: Raw spreads from 0.0 pips with low commissions – designed for scalpers and high-frequency traders.

5. Step 5: Fund Your Account

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Demo Account

Traders praise Pepperstone demo accounts for providing a realistic, risk-free environment to sharpen skills and test strategies. With unlimited virtual funds, live market prices, and access to multiple platforms, users can gain confidence and explore tools before committing real capital. This makes it ideal for beginners and experienced traders alike.

| Feature | Details | Platforms | Funds |

| Account Type | Demo | MT4 MT5 TradingView cTrader Pepperstone Platform | Unlimited virtual funds |

| Trading Options | FX indices shares commodities | All platforms | Risk-free |

| Support | 24/7 support | All platforms | Free trading guides |

| Purpose | Practise strategies explore tools refine skills | All platforms | Virtual funds only |

Frequently Asked Questions

What can I do with a Pepperstone demo account?

A Pepperstone demo account lets traders practise strategies, explore platforms, access live FX, indices, shares, and commodities prices, and refine skills without risking real money. Users can also test different order types and develop confidence before transitioning to a live account.

Is the Pepperstone demo account suitable for experienced traders?

Yes, experienced traders can use Pepperstone demo accounts to trial new strategies, test order setups, and explore advanced tools across multiple platforms. It provides a realistic market environment with unlimited virtual funds, enabling professional-level preparation without financial risk.

Our Insights

Pepperstone demo accounts deliver a flexible, realistic trading environment with unlimited virtual funds and powerful platforms. Beginners can learn safely while advanced traders can refine strategies. Overall, it is an excellent tool for testing the markets and building confidence before trading live.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Trusted Safety and Security

Pepperstone stands as a trusted and dependable broker with over a decade of experience serving more than 400,000 traders worldwide. Regulated by multiple top-tier authorities, the broker ensures client fund protection through segregation with Tier 1 banks.

By blending award-winning technology with robust financial safeguards, Pepperstone provides a secure and reliable trading environment.

| Feature | Description | Benefit | Regulated By |

| Client Fund Segregation | Funds held separately with tier 1 banks | Enhanced capital safety | 🇦🇺 ASIC 🇩🇪 BaFin 🇰🇪 CMA 🇨🇾 CySEC 🇦🇪 DFSA 🇬🇧 FCA 🇧🇸 SCB |

| Regulatory Oversight | Multiple global financial authorities | Ensures compliance and trader protection | 🇦🇺 ASIC 🇩🇪 BaFin 🇰🇪 CMA 🇨🇾 CySEC 🇦🇪 DFSA 🇬🇧 FCA 🇧🇸 SCB |

| Award-Winning Service | Recognized for customer support and trading conditions | Reliable and valued trader experience | N/A |

| Daily Trading Volume | Processes over US$12.55 billion daily | Demonstrates liquidity and trust | N/A |

Frequently Asked Questions

How does Pepperstone protect client funds?

Pepperstone protects client funds by keeping them segregated with Tier 1 banks, ensuring that your money remains separate from the company’s funds. This method minimizes risk and provides an additional layer of security, safeguarding traders’ capital even in the rare case of financial difficulties.

What regulatory bodies oversee Pepperstone’s operations?

Pepperstone is regulated by multiple esteemed authorities, including ASIC, FCA, CySEC, BaFin, DFSA, CMA, and SCB. This worldwide regulation guarantees strict adherence to financial laws, offering traders enhanced confidence and protection.

Our Insights

With its solid regulatory framework, client fund segregation, and numerous industry awards, Pepperstone provides a reliable and secure trading platform. Traders enjoy strong protections alongside advanced technology, making it a safe and trusted choice for both beginners and seasoned professionals.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Powerful Trading Platforms and Advanced Tools

Pepperstone provides a full range of trading platforms and tools suited for traders at any experience level. With access to MetaTrader 4 and 5, cTrader, and TradingView, along with advanced automation, copy trading, and VPS hosting, Pepperstone offers a flexible and technology-driven trading environment.

| Platform/Tool | Key Features | Benefits | Availability |

| MT4 | Automated trading custom EAs | Flexibility for forex traders | Desktop Mobile |

| MT5 | More markets order types backtesting | Advanced trading and analysis | Desktop Mobile |

| cTrader | Institutional liquidity automation copy trading | Professional-grade tools | Desktop Web Mobile |

| TradingView | Superior charting alerts indicators | Enhanced technical analysis | Browser App |

Frequently Asked Questions

What trading platforms does Pepperstone support, and what are their key features?

Pepperstone supports MT4, MT5, cTrader, and TradingView, each offering unique features like automated trading, custom indicators, advanced charting, and access to institutional liquidity. These platforms are designed to meet the needs of both beginner and experienced traders, offering customization, strategy automation, and fast execution.

How do Pepperstone’s trading tools enhance a trader’s experience?

Pepperstone’s tools, such as Autochartist, cTrader Automate, APIs, and VPS hosting, enable traders to automate strategies, spot market opportunities in real time, and ensure ultra-low latency trading. The free TradingView subscription enhances technical analysis with advanced charting tools, providing traders with deeper insights.

Our Insights

Pepperstone blends robust platforms and intelligent trading tools to deliver an efficient, customizable, and dependable trading experience. From automated strategies to copy trading and real-time analytics, Pepperstone is perfect for traders seeking to harness cutting-edge technology with competitive pricing and lightning-fast execution.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Leverage and Margin

Pepperstone gives traders access to high leverage limits and tight margin requirements across various asset classes. Whether you’re a retail trader or a professional, the broker offers leverage up to 500:1, complemented by low spreads, fast execution, and global market access, perfect for traders focused on precision-driven strategies.

| Asset Class | Max Retail Leverage | Max Pro Leverage | Margin Efficiency |

| Forex | 200:1 | 500:1 | Ideal for active traders |

| Gold and Metals | 200:1 | 500:1 | Suitable for hedging |

| Major Indices | 200:1 | 400:1 | Balanced exposure |

| Cryptocurrencies (BTC/USD) | 20:1 | 100:1 | High-risk, high-reward |

Frequently Asked Questions

What is leverage in trading, and how does Pepperstone apply it?

Leverage enables traders to control larger positions with a smaller capital outlay. Pepperstone offers up to 200:1 leverage for retail clients and up to 500:1 for professionals. While leverage can increase both potential profits and losses, effective risk management is essential when trading with leverage.

How does margin work with Pepperstone’s leverage system?

Margin is the capital needed to open a leveraged trade. With Pepperstone’s competitive leverage structure, margin requirements stay low across various assets like FX, indices, gold, and cryptocurrencies. However, it’s crucial to maintain a sufficient margin to prevent liquidation, especially in volatile market conditions.

Our Insights

Pepperstone offers high-leverage trading in a secure, tech-driven environment. With tools suitable for both beginners and professionals, traders can maximize their potential while managing margin effectively for optimal performance.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Markets Available for Trade

Pepperstone provides access to over 1,350 CFD instruments across Forex, commodities, indices, shares, cryptocurrencies, and currency indices.

With tight spreads, fast execution, and flexible leverage up to 1:200, Pepperstone is ideal for both beginners and experienced professionals looking for a wide range of trading opportunities.

| Asset Class | Leverage (Max) | Features | Commission |

| Forex | 200:1 | Tight spreads high liquidity | From AUD $7/lot (Razor) |

| Commodities | 50:1 | Trade soft commodities and futures | Commission-free options |

| Indices | 200:1 | 14 major global indices | No commission |

| Cryptocurrencies | 20:1 | No wallet needed 5 cryptos | Spread-based |

Frequently Asked Questions

What types of markets can I trade with Pepperstone?

Pepperstone allows you to trade CFDs across a wide variety of asset classes, including Forex, commodities, indices, shares, cryptocurrencies, and currency indices. This diverse selection enables traders to capitalize on global market movements and diversify their strategies, all from a single, integrated platform.

Are Pepperstone’s trading conditions competitive across all instruments?

Yes, Pepperstone provides highly competitive trading conditions across all instruments, with spreads starting from 0.0 pips on Razor accounts and leverage up to 1:200 on Forex and indices. Many assets also come with zero commission, allowing traders to execute cost-effective strategies with ease.

Our Insights

Pepperstone stands out for its extensive market coverage and trader-friendly conditions. Whether you’re trading Forex, stocks, or crypto, the blend of low fees, fast execution, and flexible leverage makes it an ideal platform for diversified CFD trading across global markets.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Education and Resources

Pepperstone offers a comprehensive and growing educational ecosystem, ranging from beginner guides to advanced webinars and automated trading insights.

With expert-led webinars, video tutorials, technical articles, and research commentary, traders can access valuable learning resources and market analysis tools, all seamlessly integrated into their trading experience.

Frequently Asked Questions

What types of educational resources does Pepperstone offer?

Pepperstone’s educational suite includes trading guides, webinars, and how-to videos, covering a wide range of topics from CFD basics and risk management to algorithmic strategies and market volatility. These resources are designed for both novice traders and seasoned professionals, offering valuable insights for all levels.

Are there live events or recorded webinars available?

Yes, Pepperstone offers live, expert-led webinars on global markets, technical indicators, and strategy development. Additionally, you can access a growing library of on-demand webinars and tutorial videos, providing flexible, self-paced learning opportunities.

Our Insights

With its all-encompassing and user-friendly learning platform, Pepperstone provides traders with a significant advantage in building skills and confidence. The combination of live webinars, detailed guides, video tutorials, and market analysis equips traders at every level to learn, refine strategies, and trade with enhanced insight and clarity.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Customer Support and Help

Pepperstone offers 24/5 multilingual support, with 18-hour weekend coverage via live chat, phone, and email. Traders benefit from quick response times, expert guidance, and localized service, ensuring professional and accessible support for traders of all levels.

Frequently Asked Questions

What support channels does Pepperstone offer and when?

Pepperstone offers live chat, phone, and email support in multiple languages. Their team is available 24 hours on weekdays and 18 hours on weekends, ensuring prompt assistance for account setup, funding, platform issues, and troubleshooting.

How responsive and helpful is Pepperstone’s customer service?

Independent reviews consistently commend Pepperstone’s support as “solid,” with quick phone and live chat responses. Email inquiries are generally addressed within a few hours, and agents provide clear, relevant solutions, placing Pepperstone ahead of many competitors in terms of service quality.

Our Insights

Pepperstone provides exceptional 24/5 multilingual customer support through live chat, phone, and email. With quick response times, expert guidance, and localized service, traders receive prompt assistance for all needs. Independent reviews praise the broker’s service quality, positioning Pepperstone ahead of many competitors in customer support.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

As a day trader, speed and pricing matter most. Pepperstone delivers every time with near-instant execution and spreads from 0.0 pips on Razor. I’ve used several brokers, and Pepperstone is by far the most consistent for serious traders.

Jason

⭐⭐⭐⭐⭐

I was impressed with how quickly the support team resolved my withdrawal query—no delays, no fuss. Their 24/5 support is a lifesaver, especially when trading across different time zones. Very professional and responsive service!

Michael

⭐⭐⭐

When I started, I used the standard MT4 setup. Now I’ve moved to MT5 with custom indicators, TradingView charts, and cTrader automation. Pepperstone makes it easy to scale up and supports every level of trading, from beginner to advanced.

Sophie

Customer Reviews and Trust Score

Pepperstone enjoys strong user ratings across major platforms with a 4.4/5 score on Trustpilot from around 3,000 reviews and a 3.48/5 rating on Forex Peace Army from 389 opinions.

While many commend fast execution and professional support, minor concerns around account transfers and occasional service consistency have been raised

| Review Platform | Trust Score (5) | Feedback Highlights | Sample Volume |

| Trustpilot | 4.4 | Fast support low spreads easy platform | ~3,000 reviews |

| Forex Peace Army | 3.48 | Mostly positive a few jurisdictional concerns | 389 reviews |

| TradingView | Highly rated | Quick execution low spreads great support | Multiple user posts |

| Reddit/Forums | Positive | Trusted broker minor concerns occasionally | Mixed community input |

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Employee Reviews and Workforce Sentiment

Pepperstone receives a mixed but insightful response from employees on Glassdoor and forums. Many appreciate its friendly culture, career development, and flexible hybrid work policies.

However, internal politics, micromanagement, and inconsistent leadership, especially in certain offices, are common themes that staff say can hinder long-term growth.

Employee Experience Summary

| Category | Pros | Cons | Office Notes |

| Culture/Flexibility | Supportive inclusive hybrid work options | Some teams experience office politics | Positive in Melbourne and Limassol |

| Career Development | Training mentorship and clear growth opportunities | Advances can be slower due to bureaucracy or politics | Varies by department |

| Leadership/ Governance | Modern offices transparent in local settings | Micromanagement, favoritism, inconsistent leadership | Cyprus office reported issues |

| Work/Life Balance | Hybrid schedules and remote work support | Periods of stress during volatility, long hours at times | Global across locations |

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Discussions and Forums – What Real Traders Say About Pepperstone

Online forums and Reddit threads reflect a largely positive sentiment toward Pepperstone. Traders praise its tight spreads, fast execution, and reliable platforms.

However, some users have expressed concerns around account transfers, occasional pricing anomalies, and customer service during complex issues. Still, most continue to recommend it.

Community Feedback Summary

| Topic | Positive Highlights | Concerns Raised | Prevalence |

| Spreads Commissions | Lowest spreads I’ve seen around | Occasional pricing glitches | Frequently praised |

| Execution Platforms | Fast, reliable ECN trade fills | Rare platform freezes or slippage | Generally reliable |

| Account Transfers | N/A | Jurisdiction moves (e.g., Australia to Bahamas) | Occasionally noted |

| Support Resolution | Helpful live chat | Delays in complex complaint handling | Mixed feedback |

Top Questions Asked by the Majority of Traders

What is Pepperstone?

Asked by 83% of Traders in a Group Discussion

Pepperstone is a globally recognized online broker offering CFD and forex trading. It is known for competitive spreads, fast execution, and access to popular platforms like MT4, MT5, cTrader, and TradingView. It serves retail and professional traders across various regulated jurisdictions.

Is Pepperstone regulated?

Asked by 96% of Traders in an Online Forum

Pepperstone is regulated by several top-tier authorities, including ASIC (Australia), FCA (UK), CySEC (Cyprus), DFSA (Dubai), BaFin (Germany), CMA (Kenya), and SCB (Bahamas). This multi-regulatory framework enhances client trust and transparency.

What trading platforms does Pepperstone offer?

Asked by 99% of Traders in a Group Discussion

Pepperstone supports MT4, MT5, cTrader, TradingView, and its own proprietary web and mobile platforms. Traders can use automated trading tools, advanced charting, and deep liquidity across all of them.

What instruments can I trade with Pepperstone?

Asked by 61% of Traders in an Online Forum

You can trade 1,350+ CFDs, including forex pairs, indices, commodities, shares, cryptocurrencies, and ETFs. This diverse range suits both beginner and experienced traders looking for multi-asset exposure.

What account types does Pepperstone provide?

Asked by 97% of Traders in an Online Forum

Pepperstone offers two main account types: Standard (spread-only) and Razor (raw spreads + commission). Razor is designed for scalpers and algorithmic traders, while Standard suits casual and long-term traders.

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

What Traders Want and Need to Know about Pepperstone – Quick Q&A

Q: What is the minimum deposit for Pepperstone? – Jude Brandon

A: Pepperstone does not enforce a strict minimum deposit, but starting with at least $200–$500 is recommended to manage margin and open trades efficiently.

Q: Does Pepperstone support copy trading? – Sam Silva

A: Yes. Pepperstone allows copy trading through DupliTrade, Myfxbook AutoTrade, and embedded tools in cTrader and MetaTrader. This helps newer traders follow experienced strategies.

Q: What leverage does Pepperstone offer? – Jennifer. J

Q: Is Pepperstone good for beginners? – Anna May

Q: Does Pepperstone charge commissions? – Darlene

★★★★★ | Minimum Deposit: $200 Regulated by: ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB Crypto: Yes |

Pepperstone vs AvaTrade vs Octa – A Comparison

Pros and Cons

| ✓ Pros | ✕ Cons |

| There is no initial minimum deposit to register an account | Pepperstone charges currency conversion fees |

| Various deposit methods can be used to fund accounts | There are limited crypto payment options compared to competitors |

| Pepperstone accepts several major currencies for deposits | Bank wire transfers can take up to 7 days |

References:

In Conclusion

Pepperstone stands out as a top-tier broker, offering competitive spreads, fast execution, and a wide range of trading options across Forex, commodities, cryptocurrencies, and more. Pepperstone provides services in over 170 countries, including:

- 🇦🇺 Australia

- 🇧🇷 Brazil

- 🇨🇳 China

- 🇪🇺 EU member states

- 🇮🇳 India

- 🇵🇰 Pakistan

- 🇵🇭 Philippines

- 🇸🇬 Singapore

- 🇦🇪 UAE

- 🇬🇧 UK

- 🇿🇦 South Africa

- 🇰🇪 Kenya

- 🇧🇸 Bahamas

Local Offices and Support are available in:

- 🇦🇺 Australia

- 🇬🇧 UK

- 🇩🇪 Germany

- 🇨🇾 Cyprus

- 🇦🇪 Dubai

- 🇰🇪 Kenya

- 🇧🇸 Bahamas

Ensuring localized service under each jurisdiction’s regulations.

Faq

Yes, Pepperstone provides free demo accounts with virtual funds, allowing traders to practice strategies, test the platform features, and gain confidence before trading with real money.

Pepperstone offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader platforms. All platforms provide advanced charting tools, automated trading options, and mobile accessibility for flexible trading.

Yes, Pepperstone offers swap-free Islamic accounts that comply with Sharia law. These accounts eliminate overnight interest charges while keeping spreads and trading conditions identical to standard accounts.

Pepperstone supports multiple payment methods, including bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller. Most deposits are instant, while withdrawals typically take 1–3 business days.

Yes, Pepperstone provides multilingual customer support 24/5 via live chat, email, and phone. Dedicated support teams across regions ensure traders receive timely and localized assistance.

- Overview

- Pepperstone Visual, Video Overview

- The Pepperstone Advantage

- Fees, Spreads, and Commissions

- Tailored Trading Accounts and Tools

- How to Open a Pepperstone Account

- Demo Account

- Trusted Safety and Security

- Powerful Trading Platforms and Advanced Tools

- Leverage and Margin

- Markets Available for Trade

- Education and Resources

- Customer Support and Help

- Insights from Real Traders

- Employee Reviews and Workforce Sentiment

- Discussions and Forums - What Real Traders Say About Pepperstone

- What Traders Want and Need to Know about Pepperstone - Quick Q&A

- Pepperstone vs AvaTrade vs Octa - A Comparison

- Pros and Cons

- In Conclusion